In A Progressive Tax System Quizlet

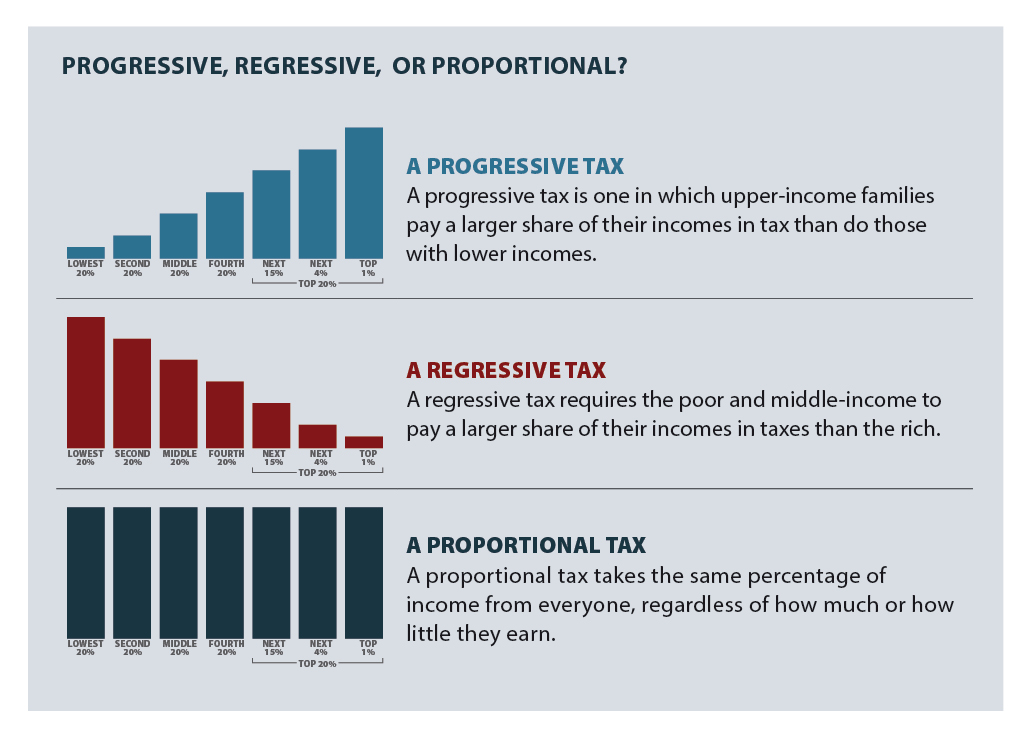

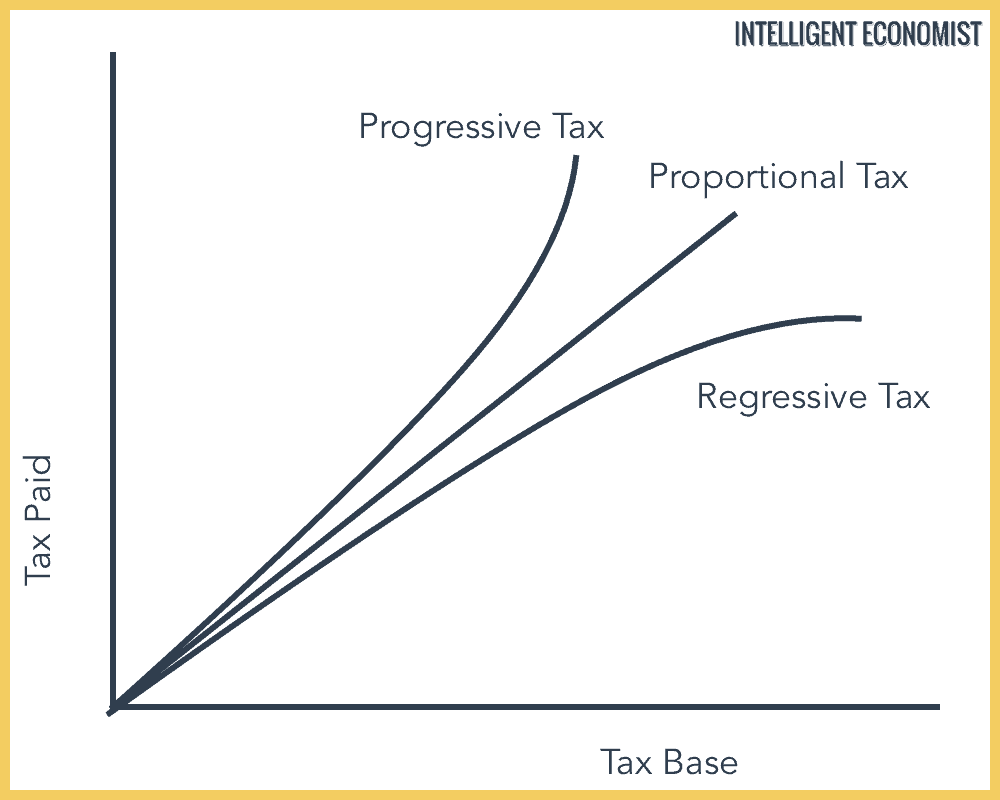

In a progressive tax system quizlet. Sales taxes are regressive because people with lower incomes pay a larger percentage of their income for sales taxes than people with higher incomes do. A proportional tax stays constant. Regressive tax tax that imposes a smaller burden relative to resources on those who are wealthierIts opposite a progressive tax imposes a larger burden on the wealthyA change to any tax code that renders it less progressive is also referred to as regressive.

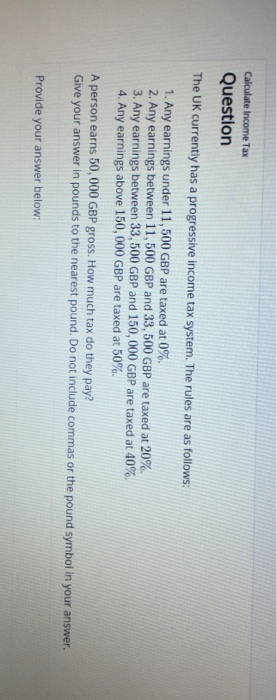

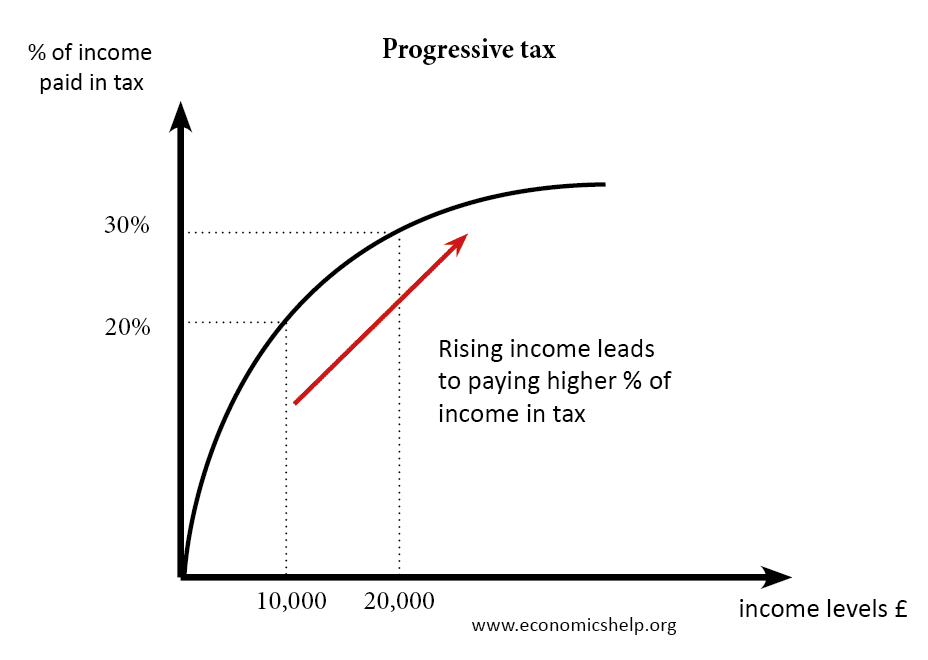

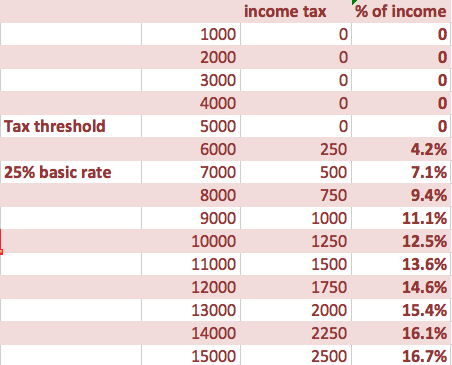

Click to read more on it. A tax system that is progressive applies higher tax rates to higher levels of income. A progressive tax is a tax in which the tax rate increases as the taxable amount increases.

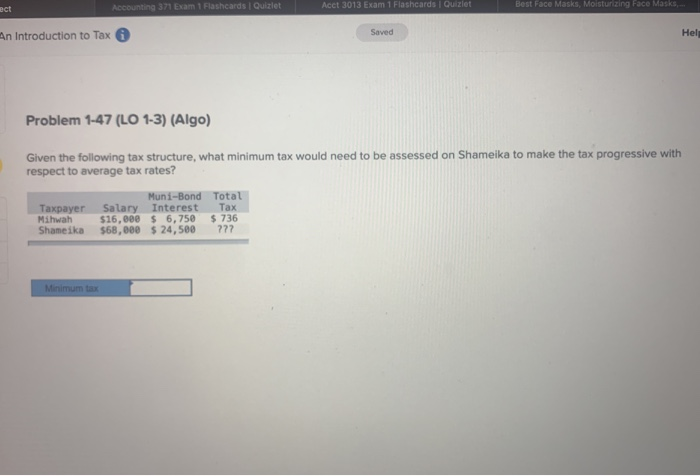

Q005 in a progressive tax system quizlet. Quizlet Plus for teachers. The higher-earning taxpayer would pay a larger total amount in taxes and would be taxed at a higher rate.

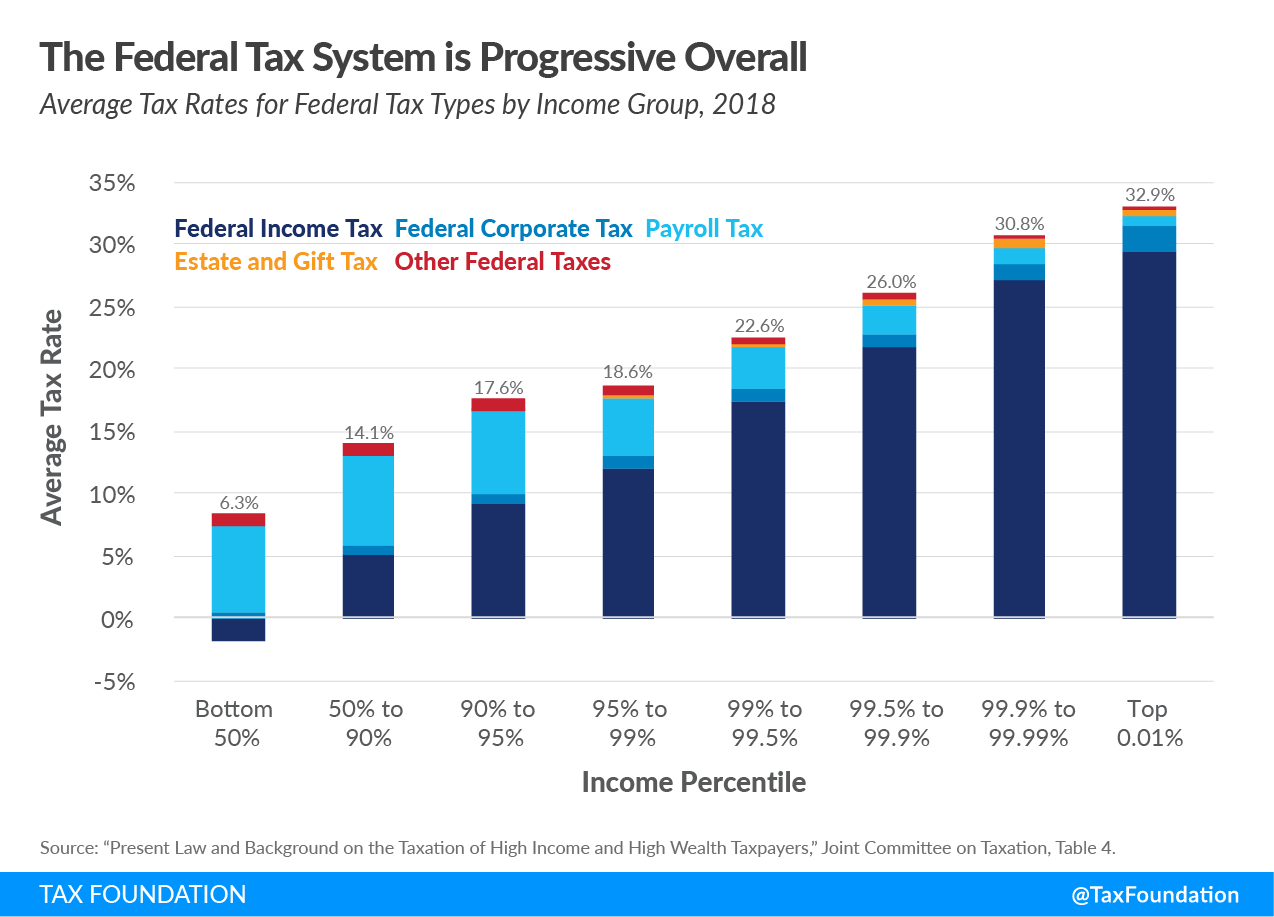

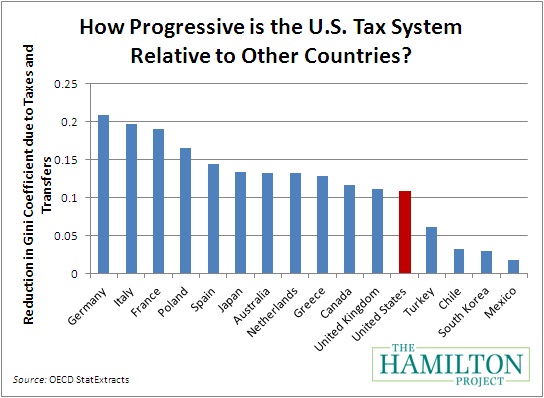

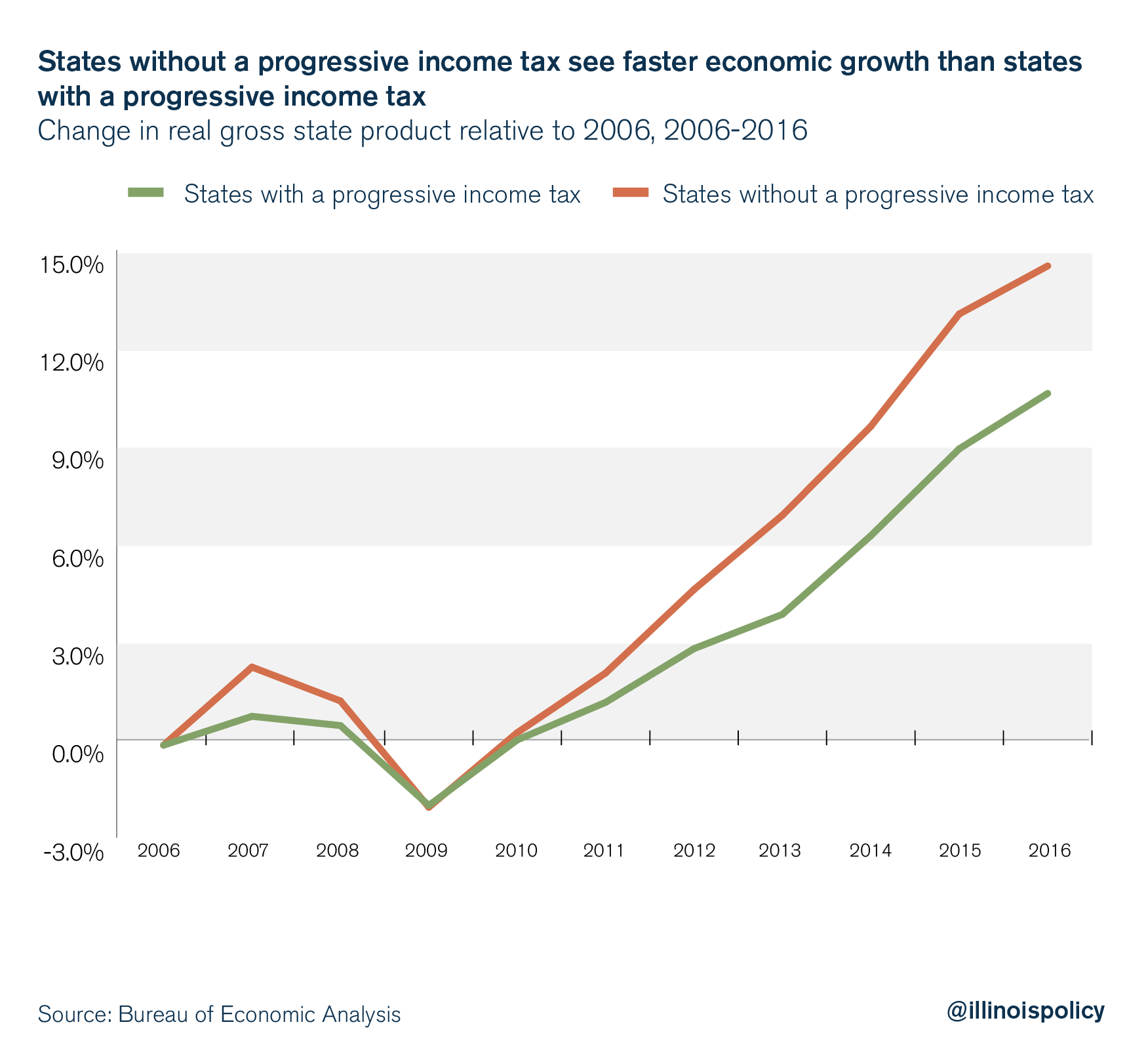

Suppose a progressive tax system is implemented with a rate of 5 on income of 0-40000 a rate of 8 on income from 40001 to 100000 and a rate of 15 on all income over 100000. Start studying Progressive Tax. The income tax system in the United States is considered a progressive system although it has been growing flatter in recent decades.

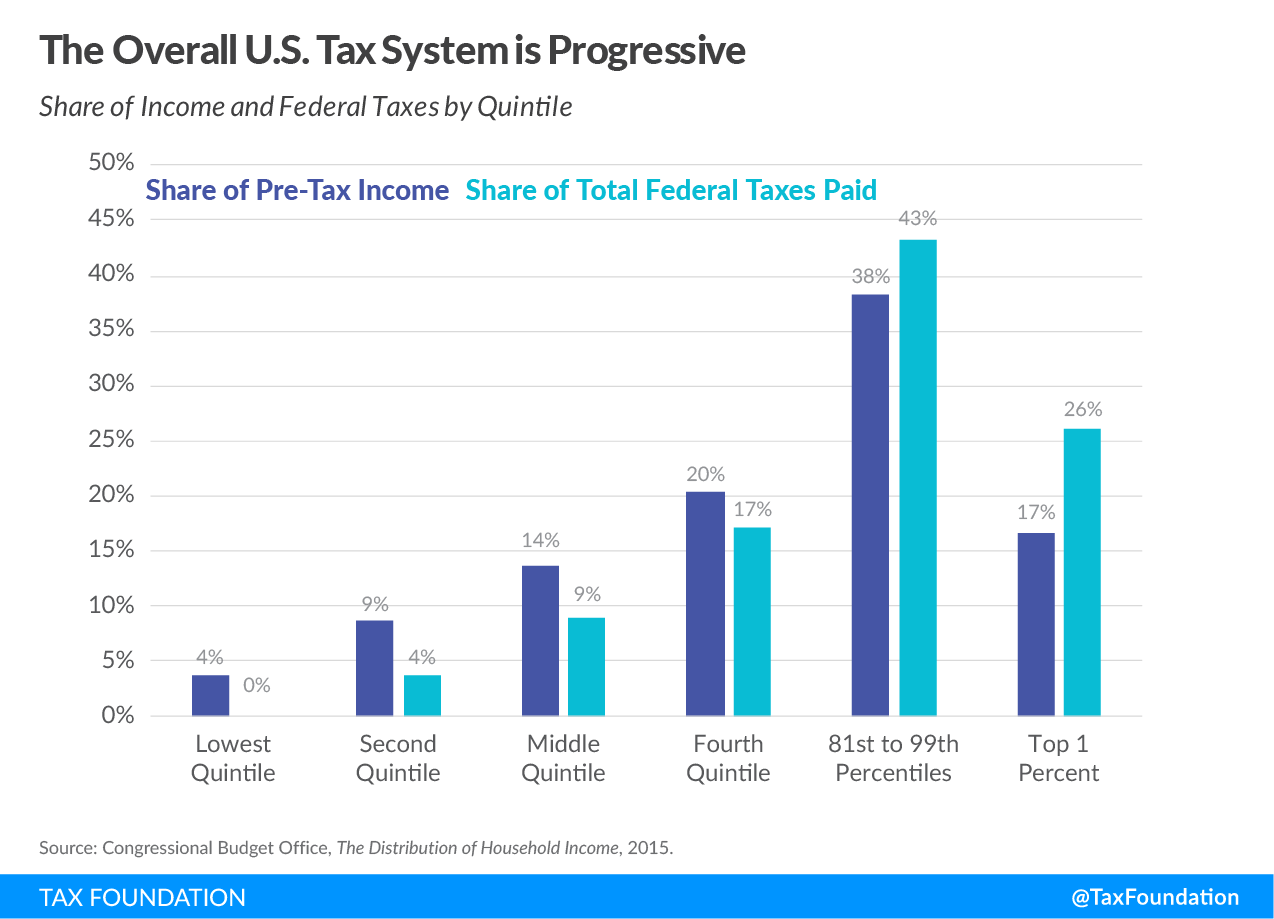

Tax revenues will rise with GDP under progressive and proportional tax systems and may rise fall or stay the same under a regressive tax system. For example taxpayers may pay 25 of their income in taxes up to a certain amount and 35 of everything. The more progressive the tax system.

Cant find the question youre looking for. A progressive tax varies directly with income. This is where skilled professionals leave the country to find work elsewhere.

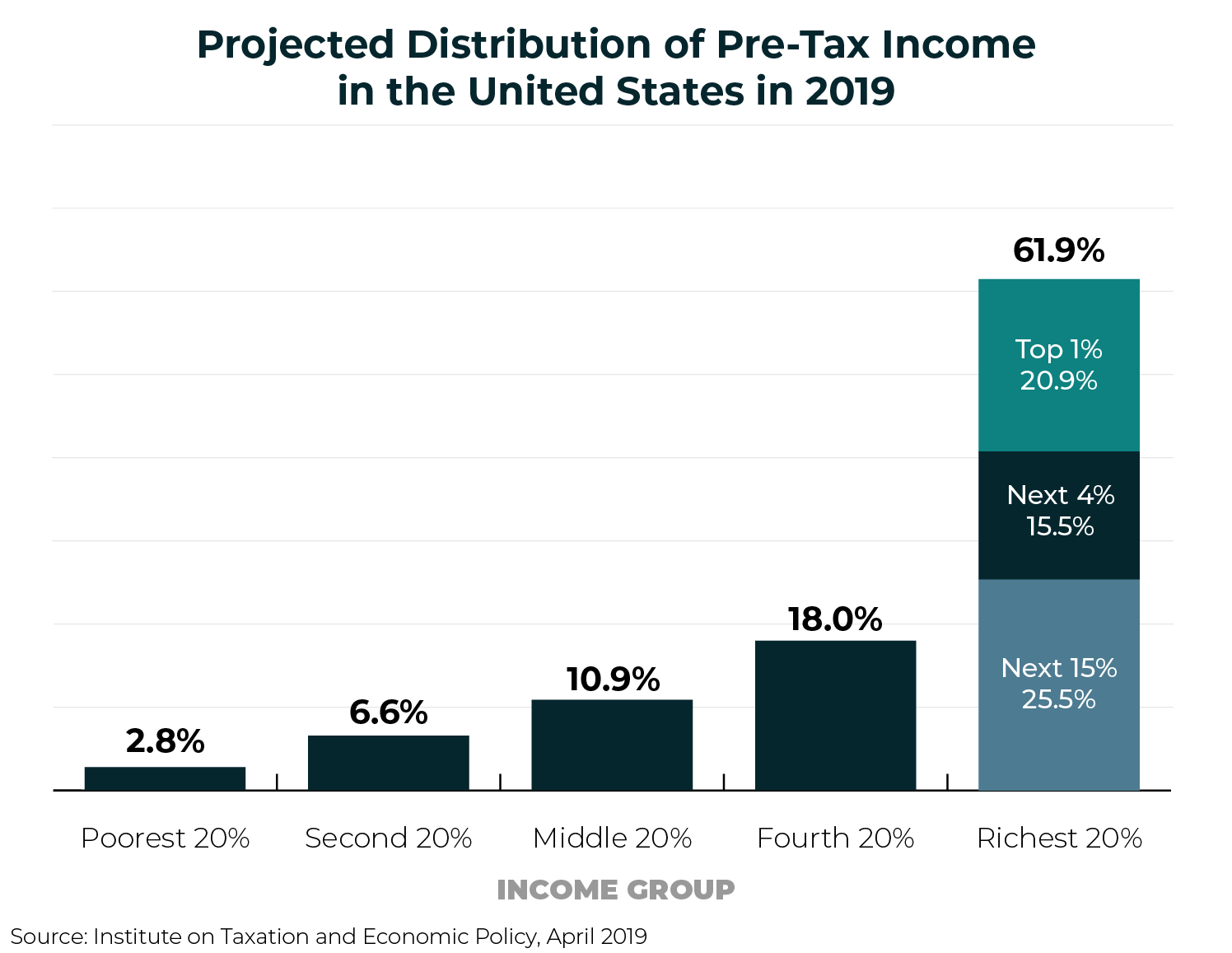

This design leads to higher-income individuals paying a larger share of income taxes than lower-income individuals. That is taxpayers pay more in taxes if they earn more in income.

It achieves this by applying higher marginal tax rates to higher levels of income.

A progressive tax varies directly with income. A proportional tax stays constant. Take a smaller share of income as the amount of income grows. How would the tax burdens of these two individuals differ under a progressive taxation system. Neither the demand for gasoline nor the supply of gasoline is perfectly elastic or inelastic. Likewise people ask what is a progressive income tax system quizlet. Sales taxes are regressive because people with lower incomes pay a larger percentage of their income for sales taxes than people with higher incomes do. How to shoot slide film Q006 Texans are unlikely to vote for an income tax in the foreseeable future becausevoters and businesses alike are attracted to a state with no income tax. Q005 in a progressive tax system quizlet.

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. That is taxpayers pay more in taxes if they earn more in income. Found insideThis is the story of how public goods in this countryfrom parks and pools to functioning schoolshave become. Quizlet Plus for teachers. The income tax system in the United States is considered a progressive system although it has been growing flatter in recent decades. All households pay the same amount of taxes irrespective of their income. Regressive tax tax that imposes a smaller burden relative to resources on those who are wealthierIts opposite a progressive tax imposes a larger burden on the wealthyA change to any tax code that renders it less progressive is also referred to as regressive.

:max_bytes(150000):strip_icc()/LafferCurve2-3509f81755554440855b5e48c182593e.png)

Post a Comment for "In A Progressive Tax System Quizlet"